It’s not just the bad concrete

by Eric Jackson

December 2009, quoted in a US embassy cable

released by WikiLeaks

January 2010, quoted in a US embassy cable

released by WikiLeaks

January 2016 address at the start of the new National Assembly session

Yes, there is the celebrated “crack,” the cause and nature of which neither Panama Canal administrator Jorge Quijano nor the canal minister, Roberto Roy, have forthrightly discussed before the press or public. But things get out, and even if Quijano ducked the questions at a December 18 shipping industry meeting, three days later the Panama Canal Authority (ACP) sent out an update to those media to which it will release information. That note said that the testing of the new Atlantic Side locks will not begin before April. The gCaptain shipping website put two and two together and figured that this means that the previously announced April opening date will be missed. It will be another delay for a project that was supposed to be up and running in August of 2014. The website attributed the delay to a “crack” in a Pacific Side locks sill.

However, three other matters, two alluded to in some of Panama’s Spanish-language media and another not, are also driving the delay. Perhaps the closest thing to an official estimate of how long the delay will be came from President Juan Carlos Varela in his January 2 address at the opening of the current legislative session. He told the deputies and the nation of a job to be completed “around the month of May,” and immediately cast doubt on that by pleading with the contractors to “allow the job to be completed” and fight their legal battles before the designated panels rather than in the press. The president didn’t get into much detail beyond that.

The bad concrete pour — and it was that, rather than insufficient rebar that the GUPC consortium alleges and the ACP won’t dispute in public — may have contributed to the delay but the fix that is being accepted, such as it is, will be finished this month at a reported cost of about $40 million to the contractors. Whether the companies involved can all afford their shares of that expense, and the further costs of finishing the job, are questions hinted at in the Spanish-language press. But the possiblity that the formerly leading partner in the consortium, Spain’s Sacyr, simply can’t afford to go on is a taboo subject both in Panamanian and Spansh corporate mainstream media.

Can Sacyr take the hit?

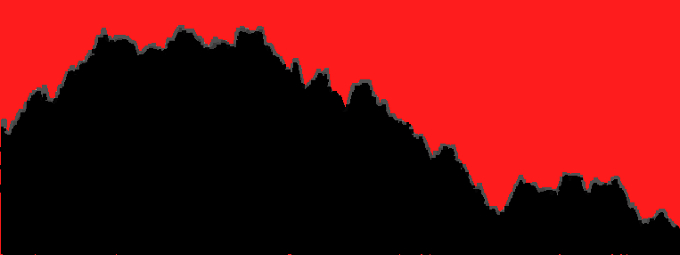

Has there been insider trading? The sharp decline in Sacyr prices began weeks before the world saw water pouring through an immense sill that was supposed to be watertight in the middle of August. Sacyr prices rallied for a time on reports that the problem was known not to be serious, and then slid again when it became clear that things were worse than initially represented. Of course, share prices may not reflect underlying value. With a company like Sacyr that’s traded on public markets, however, look at share prices as something akin to bettors’ odds, with a herd mentality behind those thought to have done their homework.

Sacyr and the other major partner in the GUPC consortium, Italian construction giant Salini Impregilo, may have dodged a bullet when the ACP accepted cheaper substandard repairs on a bad concrete pour — inserting steel reinforcing bars and cement instead of tearing out and redoing the improper work — but their shares of that repair are on the order of $20 million each. It may be little more than a trifle to Impregilo, but the Italian company is a lot healthier than Sacyr.

Is Sacyr a conglomerate, with other businesses on which it can fall back? Yes it is, but that’s part of its problem. In the heady days before the 2008 finance, real estate and construction crash, Sacyr diversified into the oil industry. As a big player in road construction in Spain and several Latin American countries, this seemed like, among other things, a good way to secure its asphalt supply. But the oil bust has taken that part of Sacyr’s business down along with the economies of places like Venezuela. Is Sacyr politically connected, protected and subsidized, a “too big to fail” company whose collapse could bring the entire economy of Spain down with it? Yes, it’s one of those and neither of the parties that have sustained it for many years, the conservative Partido Popular or the nominally socialist PSOE, won a majority or a reasonable shot at putting together a stable ruling coalition in the December 20 Spanish elections. In the last trading session of 2015, Sacyr shares continued in free fall with a 2.06 percent retreat on the day. On one day in December, Sacyr stock lost more than €1 billion in value.

Sacyr was known to be a sick company when in 2009 it parlayed a lowball bid and a piece of the action to former canal administrator Alberto Alemán Zubieta’s family into new-found prestige as the head of the consortium with the most important of the Panama Canal expansion contracts. In the Spanish media little was published to diminish that prestige, even when the government bailed the company out over bad oil investments, and when later it came out during the late 2013 and early 2014 canal expansion shutdown and corporate shakedown that the performance bond that was paid out by Swiss insurers had been bought by the Spanish government. Even when the new Cocoli Locks sprang a leak Spain’s corporate mainstream didn’t draw any connection with Sacyr’s health. But investors apparently did notice, and the ACP’s information control games about the situation were cause for further alarm. Maybe they also noticed that now it’s executives from Impregilo, not Sacyr, who are making public statements for GUPC.

In late December it was Sacyr CEO Manuel Manrique who sent a letter to the ACP asking for a $190 million loan. That request was rejected.

So why didn’t the ACP demand the usual thing for a concrete construcion error of the sort we have seen, the removal of the faulty work and its reconstruction? Did they know that had they stuck to construction industry norms it could have led to Sacyr’s collapse? And is a potential Sacyr failure — this time without the Spanish government in a position to prop the company up again — the backdrop to the new delays?

Delays in training as well as construction

From the start PanCanal pilots had doubts about the physics of the new locks, through which ships are to be pulled through the chambers by tugs that are also in the chambers rather than by locomotive mules running alongside. The concerns expressed during the canal referendum campaign were cross currents from gates that open and close from the side and the turbulence of prop wash from the tugs inside the chamber. Later questions were raised about high winds, the angles of the lines between the tugs and the ships and the massive inertia that must be overcome to move or stop a huge post-Panamax ship. Pilots complained that the video simulators on which the ACP was training them for the new locks had unrealistic settings.

To address such concerns, the ACP announced that it would obtain a post-Panamax ship on which pilots and tug captains could practice. However, they found that post-Panamax container ships for this purpose are unavailable on the market. Belatedly the authority was able to strike a deal to rent a tanker of the right size for training to begin at the Atlantic Side locks. Plus the ACP has built a 1/25 scale model of the new locks, with working model ships and tugs for the pilots’ and tug captains’ training. While there are doubts about the new simulators as well, pilots and tug captains are generally satisfied that they create a better practice model that can be tweaked to more realistically simulate conditions in the new locks. Training all of the pilots and tug captains on a single tanker rented for a reported $16,000 a day creates time and money issues that lead some to believe that there won’t be enough time to practice under real conditions.

The training issue for pilots is not just the locks. They will have to learn to navigate the channels of Gatun Lake and the Culebra Cut in massive new ships that handle differently from those to which they are accustomed, and a tanker may present some important differences from a container ship when guided through canal waters.

In any case, both the working scale model and the tanker rental come late in the game. Was the April 2016 opening date for the expanded canal was something that the ACP did not believe even as that date was still being given to the international press?

The end game in a lowball bid scheme

The lowball bid strategy is banal in the construction industry. A company or consortium gets the contract by bidding lower than can reasonably be expected to cover the costs of doing the job, let alone making a profit on it. Once the job starts, there are all sorts of extra costs that were not contemplated in the contract, or arguably were not. In any major project there actually are unforeseen contingencies that drive costs up. Usually these are in the budget and the contract includes streamlined methods to resolve disputes about these. A contingency fund and dispute resolution mechanisms are parts of the ACP’s relationship with the GUPC.

The contract for the new locks was awarded on a lowball bid to GUPC, which includes as one of its minor partners Constructora Urbana SA (CUSA). It may have only a modest stake in the GUPC, but CUSA is primarily owned by then canal administrator Alberto Alemán Zubieta’s cousin Rogelio. Alberto Alemán Zubieta had been CEO of that company before he came to work for the canal and claims that he had sold his shares in that company a few months before the bidding process on the locks. Thus, by the ACP’s definition in a nation that has no criminal laws about such things with respect to public officials in general, there was no conflict of interest. But by any ordinary international definition there was a conflict of interest and the GUPC bid, a billion dollars below the next bidder, US-based Bechtel, was widely recognized as a lowball.

This is a $3.12 billion contract, for which the ACP has already paid the GUPC $4.235 billion, some $860 million of that in advances. The ACP has acceded to paying some cost overruns running into the hundreds of millions of dollars, but in various phases of adjudication or arbitration the GUPC is asserting more than 30 claims that total more than $3.4 billion. Many of these claims were to have gone before international arbitrators in Miami in December, but at the GUPC’s request the ACP agreed to put the arbitration off until July.

Will the delay serve to shield Panamanian government officials or mostly European company managers from the wrath to come after the public, or the shareholders, perceive that their side has been rooked out of billions of dollars? Perhaps. But polls suggest that the Panama Canal Authority is the nation’s most popular public institution, with the possible exception of the Bomberos. And how can any mere cost overrun disaster further tarnish any business executive’s reputation in jaded European eyes?

Appearances do mean things to each side, however. See how a relatively tiny part of the payment dispute was recently resolved, and how the sides spun it. Three contingencies beyond the GUPC’s control caused costly lost working days. In 201l and 2012 two former Panamanian presidents died and national days of mourning were declared. In 2012 Ricardo Martinelli’s attempts to blackmail Colon into selling the Colon Free Zone’s land led to disturbances and a state of emergency that kept construction crews from coming to work. The GUPC demand for compensation was $16,434,944 but the ACP only agreed to pay $495,417. The Dispute Adjudication Board awarded $6,207,200. Similarly, the GUPC wanted $28,694,480 in compensation for a two-week construction strike in 2014 and the panel awarded it $11, 271,945. Both of these awards were discounted by the amounts to which the ACP had agreed and already paid. But the consortium, which had submitted grossly inflated claims that were mostly rejected, went on a public relations campaign to declare victory.

In that sort of atmosphere the GUPC is threatening that it won’t finish the job unless it gets more money, while the ACP is saying that if the contractors walk off the job — again — it will put its own engineers to work, hire the construction crews and finish the job by itself. That could be done, but it would probably involve some new labor negotiations with the militant SUNTRACS construction workers’ union and other procedures that would add up to new delays.

Quite often low-ball bids are used to bankrupt a subsidiary company so the parent company can claim a tax loss. I will not name names as I cannot afford a law suit, but some years ago I worked for a good builder with a solid reputation. We showed good profit every year, were highly respected. Perfect target for an unscrupulous, greedy corporate giant. The founding father of our company died, the sons sold it to a huge corporation. Within months it became apparent that the corporate giant was forcing a bankruptcy. Our little company was being forced to accept low-ball bids from subcontractors, contract terms that some of us in position to know could not possibly be met – even with a built-in overrun cushion.

When I left the company I predicted bankruptcy within in 18 months. In a little over a year I received an email from one of the left-over employees that they had declared bankruptcy and taken a huge loss for tax purposes. You read this every day in business publications.

When the Canal contracts were signed many people in Panamá scoffed at the low-ball contracts. My systems process engineer son (who was shown the project by one of the engineers when it was still being excavated) and every engineer I knew in the US said that the US contractor (Bechtel) had low-balled their bid, and when they heard that a contract had been signed for a billion less they laughed and predicted the new locks would never be completed. Intended or not, it is beginning to look like GUPC will get huge tax breaks as subsidiaries like Sacyr declare bankruptcy. Salini Impregilo seems the only part of the consortium big enough to survive.