Sincere people do it to meet legitimate needs, but so do criminals, and sometimes within the same groups

Networking

by Eric Jackson

The framework

Panamanian business has some chronic problems that stem from anti-competitive structural ways of doing things and the closely held family business organization of much of the economy. At the top, some family with an illustrious surname and an established business sends a son off to school in the United States, where he mostly just parties, and several years later he comes back and is given a management position in the business. The non-family second string in the management knows that there is no place at the top for them, and this limits their motivation. Above them, the calculation is that since they have a monopoly, or an arrangement with the few other competitors in the field, there is no need to offer anything special in order to compete, nor for that matter to avoid obnoxious practices that would drive customers away. The attitude trickles all the way down through society, down to the hardscrabble informal sector.

At the top, you may have noticed the horrid banking service we get here, and that changing banks won’t change much because they all take the better part of a month to clear a check from the USA (and so on). Or you may have paid attention to the political advertising in the recent campaigns and noticed that, for the some $115 million spent on such stuff, that none of it was very creative, let alone excellent. Panama’s advertising is an inbred social world, where the important question is to whom you are related, not the quality of your work.

Yes, there are challenges to this. There have always been businesspeople with a well developed and properly directed sense of pride. Among cabbies and other small business owners you can readily observe a growing business culture guided by a sense of ethics acquired from Evangelical churches. The better hotels, restaurants and resorts have brought in outsiders to train people in the standards of treatment that foreign customers expect. There are multinationals that have refused to let Panama’s illustrious families run their affairs, set their policies or propagate their culture within the company.

Still, the dominant business culture gives rise to comments like this, distributed recently on an English-language Panama email group:

I came here with the intention of patronizing Panama businesses, but after experiencing insufferable delays and a myriad of other problems, I turn to other ex-pats when possible.

And then, among the foreigners here, there are less than honorable folks looking to take advantage of such attitudes. Typically, they place themselves in positions to meet foreign newcomers and determine which of them have a lot of money. They especially like those who have a bit of larceny in their hearts, for example those who are moving all of their assets down here to get beyond the reach of tax authorities, creditors, the narcs or child support collectors. Such people are unlikely to seek legal recourse if they are cheated.

Tales of succession (1)

Once there was a crooked young CPA and prominent Florida GOP wunderkind, who, in the late 1980s, made two big mistakes. First, he took sides in internal Republican politics against the Bush family. Then he performed an audit on a company in which he owned a stake, and failed to report the conflict of interest. CPA license suspended and political fortunes shattered, Marc M. Harris made his way down to Panama, established a friendship with Balbina Herrera, weathered the storm of the 1989 US invasion and became Panama’s most prominent “offshore asset protection guru.” At first his operation was said to be a fairly honest system of hiding the assets of clients, many said to have been attracted from far-right American political circles with the help of a South African consul formed by the apartheid regime and a former US special operations contractor who were his two main aides. It soon degenerated, however, into just a money laundering outfit for garden variety crooks and then, as it began to crumble, into a rather ordinary investment pyramid scam.

During the Pérez Balladares administration, one level of Marc Harris’s fortunes waxed. Balbina, then a legislator, brought him in to help draft legislation. He had people infiltrated into Who’s New and the American Society, and the wife of his marketing director (the husband and Harris aide a fugitive American swindler named Brent Wagman) managed to get herself appointed as head of the annual Easter egg hunt at the US ambassador’s residence.

But also in Toro’s time, Harris’s empire began to crumble. He had a falling out with one of his Panamanian lawyers, who also happened to be on the board of directors of La Prensa. He got some unflattering press attention, and foolishly reacted to some of it by filing a libel suit in a Florida federal court, and losing that case badly. He hired hack writers to vilify journalists who reported on or criticized him, and that boomeranged, too.

Administrations changed, the cost of protection rose, and Harris fled. Not far enough, however. He’s now doing 17 years in a US federal penitentiary for financial manipulations related to US environmental law violations. But you still have former Harris people in the Panamanian offshore financial services sector, in the local legal profession and in the media here. Moreover, some of his people held onto some of his choice assets when Harris went away to prison.

Tales of succession (2)

Who’s New was once the main game in town for those monitoring the wealth of foreign newcomers. That’s where Harris sent his people. But that organization was run by Sandra Snyder (former chairwoman of the local Republicans Abroad) and her friends, for that and other reasons leaving limited room for other hustlers to network. To be sure, in his run as a teak and noni plantation scam artist, Atlanta swindler Tom McMurrain planted an aide in Who’s New, and also made his connections with Panamanian politicians. Who’s New survived the arrest and imprisonment in the United States of McMurrain, too, but the hustlers were looking for another organization that — for them — served many of the Who’s New functions but was more amenable to their control.

And thus, out of a confluence of felt needs — innocent and otherwise — an organization of “Expat Socials” was created. Soon it came under the sway of one Eddie Ray Kahn and his wife Kookie. Mr. Kahn was a convicted tax fraud guy, one who made a religion and pseudo-jurisprudence out of the urge to cheat the taxman. But he preached his weird religion at a Christmas party in a casino, people objected, he responded in a way that fed rather than diminished the controversy and then people began looking into who he was. Exit tax resistance guy Kahn, who some months later was indicted for tax fraud along with actor Wesley Snipes, and who now resides in a US federal prison.

Ah, but there were people there to pick up the pieces after Kahn. The most public face was of Laura Alexander, who’s apparently a socialite rather than a hustler. There were also people from offshore financial services companies, some of which had old Marc Harris ties, who apparently were looking for business contacts rather than victims of a confidence scheme. And then there was the scribe for their website, one Mary Sloane, who billed herself as a retired Canadian lawyer — although she doesn’t mention “retired” as in having resigned under threat of disbarment for misappropriating her client’s money and lying both to the client and the British Columbia Law Society about it.

Mary Sloan made the transition from Expat Socials to Expat Explorers, and was part of its growth into the beach and mountain communities west of the canal. She became a central figure in an expat social clique in and around Playa Blanca in Farallon and frequented XS Memories, a Santa Clara bar, restaurant and recreational vehicle park that’s popular with many expats. With her acceptance as a writer (such as it is), billing by one Donald K. Winner as a pillar of the “expat community” and her connections from the expat organizations, Sloane went into business. She co-founded Panama Magazine, and was in on the creation of London Asset Managment Inc.

Networking in the media

Arthur Youngblood Hawk is a Canadian con man. He approaches Canadian communities abroad and presents himself as a small to medium player in the publishing business. Two of his methods of operation are:

- To get people to invest in book, or online “e-book” projects, generally for other people’s work to which he doesn’t own the rights. The money is invested, the project either never materializes or shows in some sample that’s never marketed, and the investors’ money disappears; or

- Hawk, by himself or with a partner, creates a glossy publication and sells all sorts of expensive ads, but this publication either never appears, or appears only in token form (a few copies when a much larger print run was promised. Bills associated with the production, printing and web design of the publication are never paid.

The proceeds of such enterprises in pocket, Arthur Hawk moves on.

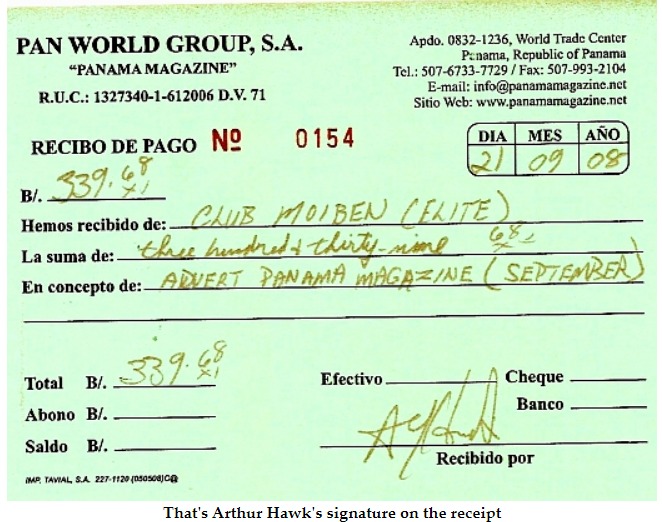

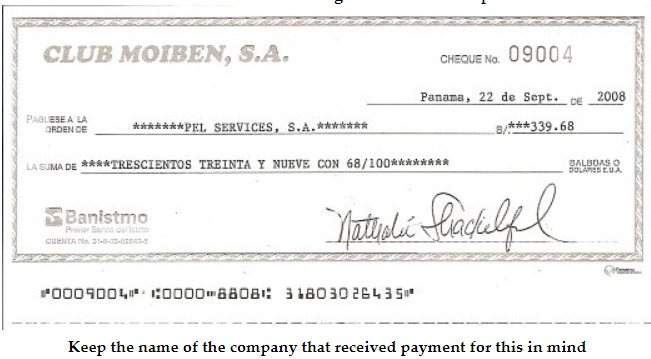

So who was Mary Sloane’s partner in Panama Magazine? Let us look at one of their receipts, and the check that it represents:

But who’s who? Hawk has described Panama Magazine in these terms:

I’m the founder and CEO of TravelerPress, a publishing company dedicated to changing the way people view Travel guides. We currently publish multi media guides in Panama, Costa Rica, Bali and soon Thailand.

…

In order to build the brand, all my publications start with the country name ie: panamamagazine, costaricamagazine, balimagazine.

…

We publish the planet’s ONLY multi media Travel/Lifestyle guides monthly or bi-monthly totally free via subscription

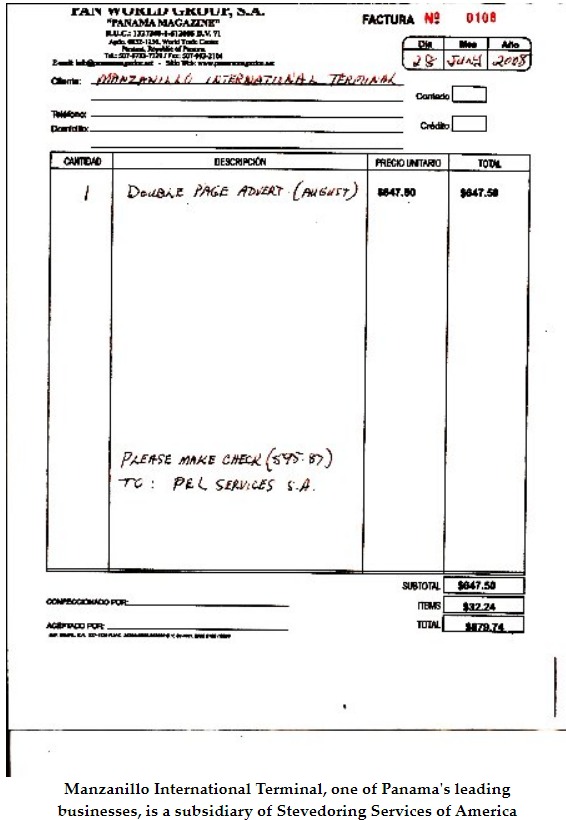

And notice who one of Sloane’s and Hawk’s marks was:

(If you look at Mary Sloane’s writings on the Expat Explorers website, you will notice that she fawns over Herman Bern (the principal beneficiary of the Cinta Costera, etc.), the Tucan gated golf course community development and the Shahanis’ Vista Mar golf course community development. It’s not hard to see what she’s up to.)

Now, caught up in a web of allegations that have given rise to at least one Panamanian court case, and with her champion Don Winner denouncing Arthur Hawk as a fraud, Mary Sloane is describing herself as one of Hawk’s victims. On the “Real Coaching Radio Network” website, Mary Sloane introduces herself in this way:

Why are you joining our network (your focus):

radio show host, RCRN fan, personal development, masterminding, collaborating, want to dominate a niche, finance, personal growth, spiritual wellbeing, life balance

Where did you hear about us:

Through Arthur Hawk

Your Primary Website:

http://www.panamamagazine.net

…

…unless we are intimately involved with the other persona and combined success is a shared goal. So for example, Arthur Hawk and I have a shared goal of making the Panama Magazine, an incredible success. Thus I can be accountable to Arthur for doing what I say and he can be accountable to me and we hold one another accountable because we share a common goal. This works but I am not sure what most of you are up to and so far we do not share common goals so I would be a poor partner for you and you would be a poor partner for me. Good intentions just don’t carry you over the hump. So get a partner who you can work with on your most important projects and combine skills, pay one another well for the skills you want them to bring to the project so that you both have every reason to want to succeed together. Then you will have a wonderful accountability partner. Live Abundantly, Mary Sloane www.panamamagazine.net…

“Live Abundantly?” Well, not through Panama Magazine. Try its website address and you get an indication that it has gone belly-up.

But Mary moved on to another slick publication that portrays Panama as this paradise for the rich where there are no black people — Panama Today Magazine, in which she is listed as vice president. Very typically, as we shall see, it is billed as a product of a “Global Village Publications Inc,” a company name designed to look similar to other, unrelated companies called “Global Village Publications” in England, Australia and India. The person listed as president of Panama Today Magazine, Michael Bartlett, claims an interesting life as a gold and uranium miner, haute restaurateur, yachtie and business partner and proétgé of one Jack Weinzierl of Advantage Conferences “marketplace ministry” disrepute. Bartlett describes himself as an “owner” at 7KAdvange, but as that controversial enterprise has run its course with bankruptcies, tax liens and people hollering that they have been separated from their lives’ savings, most of the websites associating Bartlett’s name with the “Footsteps of Faith Messenger” pitch have come down. Weinzierl, the “Christian Mentor,” is on to other things.

“Live Abundantly,” she says.

Like Eddie Ray Kahn, like Michael Bartlett’s mentor, Mary Sloane is one of these people who makes a perverse religious virtue out of hustling. On the “Spiritual Wealth” website, she declares that “I am very familiar with the Law of Attraction and the Science of Getting Rich, and practice creating abundance in my life every day, in every way.”

And are you tempted to believe? Well, if associations with wealth sweep you off of your feet, that’s the intention behind the photos in Panama Today magazine of the likes of one of Panama’s richest men, former presidential candidate and the next Minister of Economy and Finance Alberto Vallarino; or the feature on former Panamanian Business Executives Association (APEDE) president John Bennett; or all the ads for upscale real estate and luxury products might lead you to believe that the route to networking with Panama’s ruling elites is through Mary Sloane and Michael Bartlett. Like most name dropping, it’s just a hook for the gullible.

(There is, of course, another side of the equation. As in Balbina Herrera’s association with Marc Harris and former Vice President Arturo Vallarino’s plugs for Tom McMurrian’s teak and noni plantation scams, Panamanian politicians have from time to time purported to select or promote alleged leaders of the foreign expatriate communities.)

Networking in financial investments

Mary Sloane’s publishing activities are relatively small, looking at the dollars that are involved. The peculation that got her kicked out of the legal profession in Canada was also small, no more than $15,000. But all reports from all sides indicate that the losses by investors in her London Asset Management Inc. by members of Panama’s English-speaking community, primarily by Canadian expatriates, run into the millions of dollars. So how did Mary make that great leap forward?

She networked, of course. She used Zonelink owner Bob Askew to make introductions, and used her contacts from the Expat Explorers and other social circles to meet her marks. She played upon Don Winner’s endorsement of her as a pillar of the “expat community.”

But most of all, she networked with another Canadian character, one David Roland (see “Investment Opportunities,” a little more than halfway down the page that the preceding link calls up). As the note at the top of that page claims, there is a common modus operandi of using a legitimate company’s identity.

As in, assuming the name “London Asset Management Inc” and furthermore by creating a logo that falsely claims that this Panamanian corporation has offices in London, New York and Vancouver. (See, e.g., this document, part of the London Asset Management Inc letterhead.) Mary’s company thus pirated the identity of Royal London Asset Management Ltd, a company with an established reputation, which in turn is a subsidiary of a 150-year-old insurance and financial services firm.

(Note as well, when you click on Mary’s company, that one of the directors is a PEL Services, SA — the company in whose name her publishing business with Arthur Hawk was carried out.)

David J. Roland’s penchant for pirating the names of established companies includes the use of the name “Quadrant Pacific,” which belongs to a reputable New Zealand shipping agency, under which false flag corporate aegis he puts his Costa Rican investment schemes.

Like Mary Sloane, Roland is big into dropping names to promote his schemes — as in the Canadian Embassy in Costa Rica. As in KPMG; Thorsteinssons; Luis Zamora, Director of Research for the internationally renowned Coffee Research Institute of Costa Rica, ICafe; “Full Circle Canadian Company;” and the World Bank. As in Starbucks.

Mostly, people who invest in Roland’s Costa Rican schemes are told tales of losses — invariably the result of somebody else’s despicable acts — with the bottom line being that their money is gone.

In selling his Costa Rican schemes, Roland did a bit of networking with questionable Canadian brokers. In one case, a British Columbia securities broker lost her license for steering clients to invest in one of Roland’s Costa Rican enterprises, Cloud Forest Estate Coffee Limited Partnership, which the commission described as “speculative and illiquid.” According to the commissioners, when a client queried the broker about Roland’s company’s losses, “she was given platitudinous assurances as to their stability and positive prospects, rather than a blunt assessment of the potential for loss, as well as the potential for gain, that she was entitled to from a registrant.”

Roland’s Costa Rica orange grove investments are a similar tale of losses that are allegedly someone else’s fault. His website drops the name of major Costa Rican orange juice processor Del Oro. The bottom line? “The farm operation had been dealt ‘a fatal blow’ after ‘three years of upheaval,’ said management of Quadrant Pacific Growth Fund in a note to its investors earlier this year.” Money all gone. But one wonders — where, to whom?

One of David Roland’s Costa Rican enterprises comes with no published tales of loss and woe. The Mango Ranch Horse Farm is where he raises Andalusian horses.

And that may be a good point to get us back to David’s networking with Mary, and the sad tale of losses to investors in London Asset Management that they say were caused by someone else.

Mary Sloane’s and David Roland’s story, as told by their shill Don Winner, is that:

That’s Pretty Cut and Dried: In Panama the money from the “investors” (suckers) was funneled to the crooks in New York [Michael MacCaull’s Razor FX, Inc] through a company called London Asset Management (LAM). LAM has been named as a victim in the case, and they stand to receive a substantial amount of money from whatever is left in the bank accounts once the case is settled. In investigating these cases, rule number one is “follow the money.” My question – did Mary Sloane end up with a whole bunch of money that was stolen from investors? The answer to that one is no, she did not.

Well now, what’s the source for the tale that the money that Sloane and Roland collected from the investors in London Asset Management went to Razor FX? Where has London Asset Management been “named as a victim?” The only two sources that this reporter can find for those claims are Mary Sloane and Don Winner. The US Postal Inspectors, whose investigation led to the bust, don’t say that. They say that “[v]ictims of the scheme lived in the United States, Canada, the United Kingdom, and Hong Kong,” but don’t mention Panama.

On the other hand, this reporter has been told by one person who lost money in the London Asset Management scheme that his return checks went to all sorts of places in many different countries — including one to Roland’s horse farm in Costa Rica — but never to Razor FX, Inc. “So have I financed his horse farm?” the bilked investor wants to know.

Contact us by email at fund4thepanamanews@gmail.com

To fend off hackers, organized trolls and other online vandalism, our website comments feature is switched off. Instead, come to our Facebook page to join in the discussion.

These links are interactive — click on the boxes